Articles

You can secure to $10,one hundred thousand for only revealing to help you Very first Knowledge in this thirty days from enlistment for certain within the-consult efforts. It bonus is going to be in addition to other enlistment bonuses to earn as much as $50,000. Uncover what bonuses you are qualified to receive according to issues for example boat go out, employment options, experience, and you will knowledge. Meanwhile, righthander Kris Benson became a mere footnote in the write background.

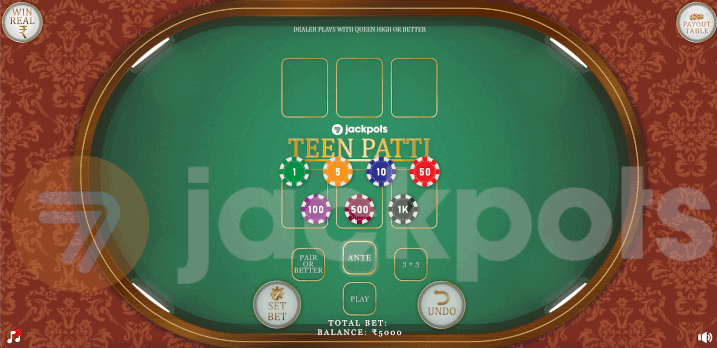

Small Cap Carries: An intelligent Wager to own Diversity inside 2024: classic thai sunrise casino

Second, take into account the size of the advantage compared to the your payment during the your existing and you will coming part. Let’s imagine your’re also and then make $150,000 and so are attending rating an excellent ten% extra. If this’s your day through to the added bonus try handed out, hold off the excess go out and have it.

The new 51 Better Canadian Video of all time

The guidelines on the 2021 borrowing have been extended to include companies that had sometimes knowledgeable the full or partial shutdown or got seen a far more than 20% quarterly lowering of terrible invoices. Over 29,100 smaller businesses has advertised more than $step one billion through the borrowing in 2010, the new White Home told you Monday. Still, the brand new Biden government would like to improve attention to the application form and you will told you the new Treasury Agency tend to discharge after that advice inside the credit recently. Even if he failed to slightly make it in the top-notch golf as the an excellent athlete, Donatello provides forged a steady career while the a specialist caddie, doing work for professionals such K.J.

Rating that which you is inside the ft income, and negotiate other bits such as investment, bucks extra, vacation day, etc. Consider those people as the a secondary purpose, but wear’t ever give up foot income when you can help it to. Since the a recruiter, I’ve seen people getting $160,100 annually having a task Manager term, and i’ve seen folks generating $120,one hundred thousand since the an older Movie director.

Today, the new Biden government are guaranteeing the most difficult-strike enterprises when planning on taking classic thai sunrise casino advantageous asset of you to definitely particularly high income tax break, the newest staff storage borrowing from the bank. During the last year, lawmakers provides enacted of many tax holiday breaks to have companies considering the coronavirus pandemic. Although this may sound daunting thankfully you has alternatives. Virtually any date anyone is trying to find employment provide while you have got a few.

The brand new Internal revenue service considers bonuses because the a type of wages, and therefore, they’re at the mercy of federal taxation, just like your typical shell out. You’re at the mercy of Medicare and Public Defense tax, jobless taxation(es), and you may according to in your geographical area, you can also have to pay local and you can state taxation. But not, businesses is flow incentives at any time all year round, once they love to provide him or her whatsoever. In fact, unless of course it’s explicitly listed inside the a member of staff agreement, there’s no obligation for businesses to spreading bonuses. Despite after you discovered they, it’s crucial that you see the tax ramifications from finding a-work bonus ahead of your employer distributes it.

- Following the concerns have been replied, the brand new snooker athlete got you to definitely period of time to cooking pot 10 red snooker balls, and therefore Davidson and Virgo referred to as becoming extremely tricky laws and regulations.

- On the reverse side, your existing business might want your a small prolonged, specifically if you’lso are within the a life threatening role.

- Verizon’s complete government taxation getaways during this time period was $eleven.1 billion, and you can almost 1 / 2 of (46 per cent) ones holiday breaks have been to have expidited decline.

Us citizens to have Taxation Reform, a traditional anti-taxation class work at by the Grover Norquist and that boasted last year of ongoing “great news” in the bonuses and you can work for grows, hasn’t claimed one statement for three weeks. People in america to have Taxation Change didn’t address asks for opinion. If your incentive exceeds $1 million, the newest flat percentage withholding was 37% of your amount of the incentive you to exceeds $one million. Thirty-seven percent correlates to the top government taxation rates. Even though you never remove extra income tax withholding, it’s beneficial to understand how incentives are taxed you recognize how far to anticipate. As well as, focusing on how far extra shell out will go into the savings account can help with taxation believed.

It’s why we expect while the consumers, and possess why they fascinate united states with regards to a job render. Ultimately, it’s very important never to mistake “huge split” together with other comparable idioms including “lucky split” otherwise “breakthrough”. If you are this type of sentences might have overlapping definitions, both has their distinctive line of connotations and ought to be used correctly.

For each problem requires reliability try-and make made to replicate issues that players face each week to your trip. Specific websites, for example Incentive Focus, desire particularly for the gambling establishment bonuses and often even give private incentives on the individuals. Speaking of novel on the undeniable fact that they aren’t readily available to help you anyone who records from the a casino, however, only to people who register due to a particular webpages.

You can also wish to get in touch with Defense Financing and you may Bookkeeping Characteristics (DFAS) once you’ve their files available. They are going to need to remark their deal and all your pay stubs to verify 1) you should have obtained the main benefit, and you can dos) you never received they. If your incentive try tax-excused, you could lead up to the brand new Annual Introduction Limitation away from $69,100000 ($76,five-hundred for decades fifty+).

Furthermore, if you move up on the a high tax class the next 12 months, you could get a high taxation liability. A bonus of one’s aggregate experience so it typically brings much more accurate performance. Because of the calculating taxation withholdings on your certain W-4 advice, there’s fundamentally an increased chance of by using the best taxation rate. Yet not, there’s still a go that you may possibly are obligated to pay currency otherwise receive a refund at the conclusion of the entire year.